When Digital Systems Lock Out Customers

Padmaja Narsipur

Blogs

Dec 5, 2025

Time for Tear-free, Thoughtful Solutions that Actually Help

I live on the outskirts of Bangalore near a large industrial area, and bank at a semi-rural branch nearby.

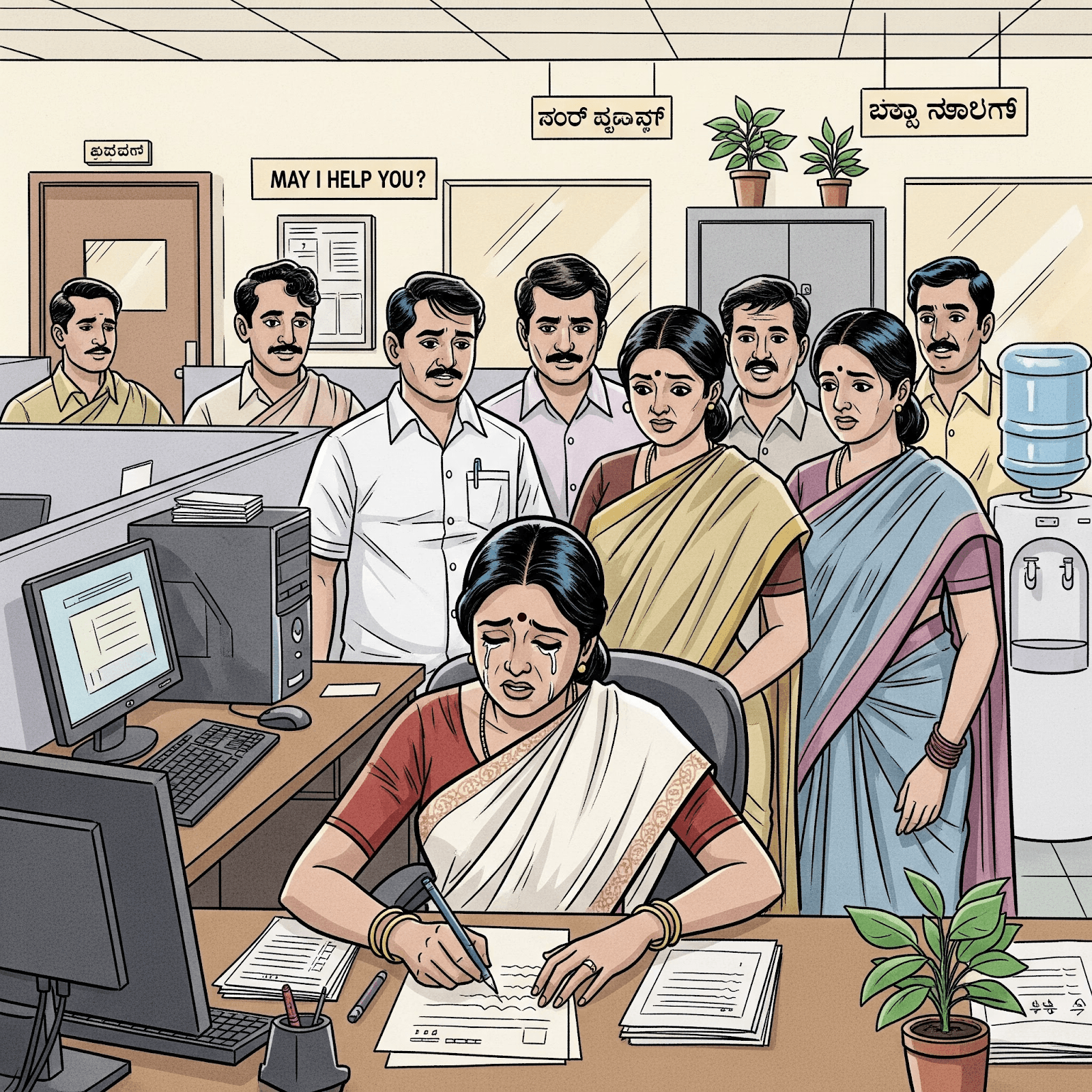

A recent visit to clear up some credit card issues was eye-opening for different reasons. The lady sitting on the chair next to me was weeping audibly as she traced something on a sheet of paper. Upon enquiring, I was told that she was due for a “re-KYC”- the annoying periodic requirement to renew our ‘Know your customer’ details with the authorities.

The lady in question, being illiterate, had made her literate sister sign her name the last time she ‘KYC’ed and was now stymied - with said sister being out of town, she had no means to renew her KYC but to learn to sign. Ergo, the staff member helping her took out a printout of the old signature and asked her to practice away. “ತಿದ್ದಿ!”(trace it!), he entreated her in Kannada, with a couple of others crowding around, encouraging her.

Complying with opaque requirements to draw her salary

So, the scene I entered into, had the poor lady sobbing and trying to manipulate unused wrist muscles into writing so that she could access her salary.

Very helpfully, (I thought!) I asked the staff to just hold her hand and help her with the signature - it may speed up the process perhaps? They hurriedly told me that CCTV cameras were observing everything they did, and helping her sign would be illegal.

Such scenes are probably playing out across the country as millions of people struggle to work with digital systems and opaque processes that are not designed for their particular needs and constraints. The digital divide is very real for them - smartphones and a raft of digital infrastructure may abound, but the thoughtfulness required to actually make them work, and impact the user on the other side, is missing.

For the banks, these are costly design failures. These users at the bottom of the pyramid are not yet too vocal about their unhappiness with systems that just don’t work. But we’ve seen the tide swellingーfor example, social media is flooded with videos, many of them in banks, of customers unhappy with staff transferred in from remote locations who cannot speak the local language. That issue can be a huge barrier for customers unused to speaking in a different language to access their own funds.

These are problems which beg for thoughtful digital solutions. Else, banks will suffer reputational damage, regulatory friction, or worse.

Imagine if the sobbing lady didn’t have to sign that paper, but could use biometrics and facial recognition. These can serve to verify a person’s identity, which is what signatures are used for in the first place. One may argue that signatures also act as a person’s approval or agreement to a process or course of action. We could take care of this by recording a simple video on the spot - we already do this for digital signatures. Even literate folks may benefit, such as senior citizens who may have tremors in their hand, people with disabilities, those who are injured, or children.

Here’s more: post-authentication, what if banks had voice-first kiosks that ask questions and request document uploads so that onerous compliance formalities such as KYC can be done with helpful chatbots? With AI in the mix, it’s feasible to provide such services in the user’s language or dialect. We can do away with many forms and documents for many bank processes if we design and build such systems. These chatbots can perhaps help the bank staff also get acquainted with the basics of local language interactions.

Banks and financial institutions can earn ultimate brand loyalty by handing out smartphones to feature phone customers, moving them firmly into the modern world. The smartphone could be loaded with voice-enabled applications that help users take care of their banking needs. A simple training video (available in the user’s language) can help them at onboarding.

Imagine if the bank had handed the unhappy lady a smartphone as a Re-KYC reward and walked her through authenticating herself and verifying her credentials with a simple app - she would have been so happy she would have probably walked back in with a few friends to get them accounts in the branch!

Areas for improvement. Missed opportunities. Room for change.